U.S. Department of the Treasury

- Two Major Divisions

- The Bureaus

- The Alcohol and Tobacco Tax and Trade Bureau

- Internal Revenue Service

- Financial Crimes Enforcement Network

- Office of Inspector General

Identification: Cabinet-level department of the federal government responsible for promoting the prosperity and stability of the nation’s economy by assisting in regulating and enforcing laws dealing with money, taxes, and other financial matters

Date: Established in 1789

Significance: The Treasury Department has a farreaching effect on the U.S. economy and all its private and public financial institutions through the department’s responsibility for managing the federal government’s finances and enforcing laws that ensure the safety and soundness of American and international financial institutions.

In 1789, the U.S. Congress passed an act that created the U.S. Department of the Treasury. This act outlined and prescribed all the department’s duties, functions, and responsibilities for maintaining, protecting, and assisting in the growth of the nation’s economy. The Treasury Department is the main federal agency charged with maintaining and securing the economic safety of the United States. Its duties include a wide range of activities, from advising the president on various economic issues, enhancing and creating corporate governance in financial institutions, assisting other countries with building a stable world economy, predicting and preventing all global economic disasters or crises, and regulating and protecting the economy of the United States by enforcing the economic and tax laws needed to maintain appropriate growth and stability of the nation’s economy.

Two Major Divisions

The Treasury Department is organized into two major components: the departmental offices and the operating bureaus. The departmental offices are responsible for the formulation of policy and management for the entire department. The operating bureaus carry out the specific tasks assigned to them by the department. Of the two branches, the operating bureaus make up 98 percent of the department’s workforce. Twelve bureaus are charged with numerous responsibilities; however, their main missions are the same, to protect and maintain the United States economy.

The basic functions of the Department of the Treasury include producing postage stamps, currency, and coinage; managing all federal finances; collecting taxes, duties, and all other monies owed to the government; paying all bills that the United States owes other nations; supervising national banks and credit institutions; advising the president and other governmental officials on financial and tax-related policies and issues; enforcing federal finance and tax laws; and investigating and prosecuting those individuals who engage in counterfeiting, forgery, or tax evasion.

The Bureaus

Of the twelve bureaus of the Treasury Department, only four are responsible for enforcing and investigating the numerous and intricate laws regarding the economic wellbeing of the United States. The four bureaus that protect and enforce the various financial and tax laws of the United States are the Alcohol and Tobacco Tax and Trade Bureau (TTB), the Internal Revenue Service (IRS), the Financial Crimes Enforcement Network (FinCEN), and the Office of the Inspector General (OIG). Until 2003, there were three other bureaus involved in law enforcement and investigative functions that operated under the auspices of the Treasury Department. However, these bureaus were reassigned and given new investigative and protective missions within the newly created Department of Homeland Security. These bureaus were the Federal Law Enforcement Training Center (FLETC), the U.S. Secret Service, and U.S. Customs (which became the U.S. Customs and Border Protection Bureau, or CBP).

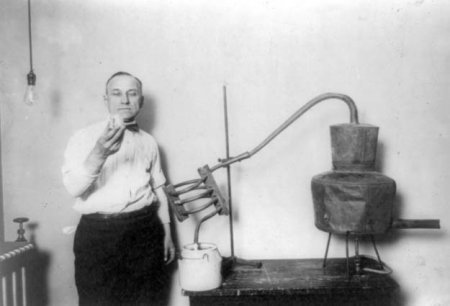

Moonshine still confiscated by the Internal Revenue Bureau, part of the Treasury Department, between 1921 and 1932. (Library of Congress)

The Alcohol and Tobacco Tax and Trade Bureau

In 2003, the Bureau of Alcohol, Tobacco, and Firearms (ATF) was split into the Alcohol and Tobacco Tax and Trade Bureau, which remained with the Treasury Department, and the Bureau of Alcohol, Tobacco, Firearms, and Explosives, which was placed under the Department of Justice. The purpose of the TTB is to collect excise taxes on alcohol, tobacco, firearms, and ammunition that are owed to the federal government and to guarantee that alcoholic beverages, tobacco products, and firearms are produced, labeled, distributed, and marketed in agreement with federal law. The TTB employs more than six hundred people, many of whom are analysts, chemists, investigators, and auditors. Tax collection as a function of the TTB originated with the original Bureau of Alcohol, Tobacco, and Firearms, created more than two hundred years ago. The ATF was one of the earliest law-enforcement and taxcollecting Treasury agencies.

Internal Revenue Service

The Internal Revenue Service is the largest of the twelve Treasury bureaus. It is responsible for determining, assessing, and gathering tax revenue in the United States. The IRS deals directly with more Americans than any other institution, public or private, in the continental United States. It also is one of the world’s most efficient tax administrators, collecting more than $2 trillion in taxes per year. One of the major goals of the Internal Revenue Service is to ensure that all Americans understand and carry out their tax obligations to the federal government. To make sure that all federal tax laws are carried out and administered fairly and justly, the IRS maintains both a collections division and a criminal investigation branch, known as the Criminal Investigation Unit (CI).

The Criminal Investigation Unit consists of nearly three thousand special agents. These agents investigate suspected cases of money laundering and violations of tax and Bank Secrecy Act of 1970 laws. Although the Internal Revenue Service shares jurisdictions over money laundering cases and Bank Secrecy Act violations with various other federal agencies, the IRS is the only agency that has sole investigative jurisdiction over criminal violations of the Internal Revenue Code.

The special agents who make up the law-enforcement arm of the IRS are some of the most elite financial investigators in the world. Financial investigations take hundreds of hours and, in some cases, involve thousands of financial records and tax statements. These Criminal Investigation agents focus their efforts on three distinct areas: legal-source tax crimes, illegal-source financial crimes, and narcotics- and terrorist-related financial crimes. Specifically, these agents look into such crimes as public and governmental corruption, tax evasion, health care fraud, telemarketing fraud, money laundering, and various other forms of finance-related frauds. Overall, the Criminal Investigation Unit has one of the highest conviction rates in federal law enforcement. Those who are prosecuted by the Internal Revenue Service usually pay severe fines and may be sent to federal prison.

Financial Crimes Enforcement Network

The Financial Crimes Enforcement Network, established by the Treasury Department in 1990, is charged with establishing, overseeing, and implementing policies to detect and prevent money laundering, terrorist financing, and financial crimes perpetrated by international organized crime.

It has worked to maximize information sharing and gathering among all branches of law enforcement and agencies in the regulatory and financial sectors to fight the complex crime of money laundering, which is thought to be the third-largest business in the world. Financial Crimes Enforcement Network’s approach, using network systems, employs cost-effective yet meaningful methods to combat money laundering both domestically and globally.

FinCEN’s maingoal is tosupport law-enforcement investigative efforts, foster interagency and global cooperation against domestic and international financial crimes, and provide U.S. policy makers with strategic analyses of domestic and worldwide money-laundering developments, trends, and patterns. Financial Crimes Enforcement Network maintains and operates one of the largest repositories of information on moneylaundering activities available to law enforcement nationally and internationally. Overall, FinCEN has been a leader in the global fight against money laundering.

FinCEN’s staff includes approximately two hundred employees, many of whom are intelligence research specialists fromboth law-enforcement and financial communities, law-enforcement support staff, and law-enforcement and legal analysts. In addition, there are approximately forty long-term detailees from twenty different law-enforcement and regulatory agencies from around the United States. As part of a collective bureau, these individuals are charged with finding the links between the individuals and financial institutions engaging in money laundering.

Office of Inspector General

The Office of Inspector General (OIG) was established in 1989 by the secretary of the Treasury. The OIG is led by an inspector general appointed by the president of the United States with the consent of the Senate. The inspector general reports to the secretary of the Treasury through the deputy secretary. The inspector general provides the secretary with independent and unbiased reviews of all department operations. The inspector general is also required to keep the secretary and the entire Congress up to date regarding all problems, concerns, and deficiencies relating to the administration of department programs and operations. Serving with the inspector general is a deputy inspector general, who is responsible for assimilating all bureau reports and investigations. Aside from the inspector and the deputy, the Office of Inspector General has a staff of one hundred full-time civil servants who are responsible for record keeping, external auditing, report writing, and internal investigations. In regard to investigations, it is vital that all erroneous or criminal behavior be dealt with at once. Audits and investigations that indicate any form of specious or suspected criminal activity are usually passed on to the Department of Justice for further investigation and appropriate action. It is the main goal of the OIG to act as an internal investigation mechanism for the Department of the Treasury, so that a fiduciary environment in which the United States economy can grow and prosper can be achieved and maintained.

One of the main tasks of the Office of Inspector General staff is to create and submit semiannual reports regarding the activities and investigations of the office. Disclosures of problems, abuses, and deficiencies in the Treasury department are highlighted and brought to the attention of Congress and to the secretary of the treasury. The reports also offer recommendations of what the department should do to correct particular abuses and deviancies. Overall, the OIG plays an integral role for the Department of the Treasury by making sure that all operations by the twelve bureaus are carried out efficiently and without corruption and deceit.

Paul M. Klenowski

Further Reading

Kaufman, Judith, ed. United States Department of Treasury: Current Issues and Background. New York: Nova Science Publishers, 2003. Provides both a historical overview and an in-depth understanding of prominent issues facing the Treasury.

Kinsey, J. C. Working for the IRS. Cutten, Calif.: Iris Books, 1997. A former IRS auditor shares some important facts about the workings of the Treasury.

Terrell, John. The United States Department of Treasury: A Story of Dollars, Customs, and Secret Agents. New York: Duell, Sloan, and Pearce, 1966. Offers a great historical look at the Treasury, from its inception through the early 1960’s.

Walston, Mark. The Department of the Treasury. New York: Chelsea House, 1989. A basic explanation of what the department is and does.

Yancey, Richard. Confessions of a Tax Collector: One Man’s Tour of Duty Inside the IRS. New York: HarperCollins, 2004. This text offers a personal look of one man’s experience as an employee of the Internal Revenue Service.

See also: Alcoholic beverage industry; Currency; drug trafficking; Hamilton, Alexander; U.S. Mint; Federal monetary policy; Prohibition; Taxation.