Costs

When business managers change the level of output, they do so by changing the quantity of resources, called inputs, used to produce the output. As the number of inputs change, the firm’s costs change. There are many types of costs: total costs (TC), total fixed costs (TFC), total variable costs (TVC), average total cost (ATC sometimes shown as AC), average variable cost (AVC), average fixed cost (AFC), and marginal cost (MC).

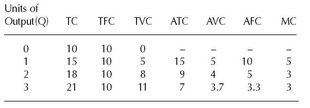

To understand the various costs, it is necessary to distinguish between fixed and variable costs. Fixed costs are those that do not change during the period of time and range of output under consideration. When the planning period is relatively short, some inputs, such as the size of the factory and number of machines, are constant; while other inputs—labor, materials, and energy—change with the level of output. Total costs can then be separated into fixed costs and variable costs. Using the table below, each of the cost concepts can be defined.

Total cost equals the sum of total fixed costs and total variable costs at each level of output: TC = TFC + TVC. Total fixed costs equal total costs minus total variable costs: TFC = TC – TVC. Note that in the table above, total fixed costs do not change as the units of output increase. By definition, fixed costs are fixed. Note also that when the firm has no output, total costs equals total fixed costs. When a firm has no output it has no variable costs, only fixed costs. For example, a new company, such as a bank, leases a building, gets a business license, obtains a charter with the banking authorities, hires office staff, rents computers and office equipment, and makes other expenditures before it ever opens its door for business. All of these costs are fixed costs.

Total variable costs equals total costs minus total fixed costs: TVC = TC – TFC. Variable costs are costs that change as the firm produces more output. For a bank, variable costs would include labor, communication costs, and costs of funds (interest paid).

Average total cost equals total cost divided by the number of units produced: ATC = TC/Q. Notice in the table above that there is no figure when the level of output is zero; division by zero is undefined. The same is true for average variable cost and average fixed cost.

Average variable cost equals total variable cost divided by the number of units produced: AVC = TVC/Q. Average fixed cost equals total fixed cost divided by the number of units produced: AFC = TFC/Q. Notice that AFC decreases as output increases. This is known as “spreading your fixed costs.” One of the reasons a small business, like a new bank, will want to grow as fast as possible is to spread the initial start-up costs (fixed costs) over a larger volume of output (loans and other

ASSETS).

Marginal cost equals the change in total cost divided by the change in output: MC = change in TC/change in Q. In the table above, there is no figure for marginal cost when output is zero; there is no information to compare the change in total cost and change in marginal cost. But when output increases to one unit, total cost increases from 10 to 15, a difference of 5, and output changes from 0 to 1, a change of 1. Therefore marginal cost is 5/1 = 5.

Marginal cost is a very useful concept to business managers. Often managers are faced with new choices or situations. Open a new location. Add a new line of products. Stay open additional hours. Have the employees work overtime. In each of these situations, a manager would like to know how much more will it cost to do this. Marginal cost answers this important question.

There are other ways to calculate costs. TC = TFC + TVC. Total cost also equals average total cost times the number of units of output: TC = ATC x Q. Similarly, TFC = AFC x Q, and TVC = AVC x Q.

Average total cost can also be calculated by adding AFC + AVC at each level of output; therefore AFC = ATC – AVC and AVC = ATC – AFC.

Often, in a business situation, a manager will only have limited information about what costs are or will be. If a manager can estimate cost per unit (average total cost) in a range of output and then compare to the price they expect to be able to sell the product for, they can make the decision whether or not to pursue that activity.

Summary of cost relationships:

TC = TFC + TVC, or TC = ATC x Q

TFC = TC – TVC, or TFC = AFC x Q

TVC = TC – TFC, or TVC = AVC x Q

ATC = TC/Q, or ATC = AFC + AVC

AVC = TVC/Q, or AVC = ATC – AFC

AFC = TFC/Q, or AFC = ATC – AVC

See also

MARGINAL ANALYSIS;

PROFIT MAXIMIZATION;

TRANSACTION COSTS.