Credit cards history

Plastic cards that pay for financial transactions by extending credit to the user when the purchase or transaction is complete. The company issuing the credit card then collects the balance due from the customer upon demand or over time by extending revolving credit, for which a rate of interest is charged.

The general idea for credit cards originated in the 19th century as a vision of a utopian future society. In Looking Backward, 2000–1887, published in 1888, Edward Bellamy accurately foresaw the introduction of credit cards in the 20th century when he predicted that many transactions would be cashless, using a form of identification card. The actual mechanism by which payments would be collected was a more difficult issue and would have to await developments in computer technology.

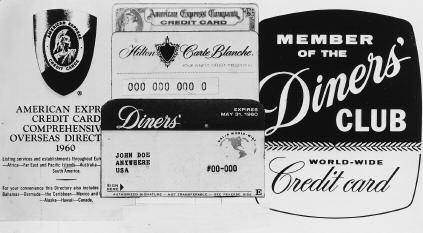

The first credit card was developed by Diners Club after the Second World War, and it required the balance to be paid in full when due. In the mid-1960s, a new card was developed by the BANK OF AMERICA—the Visa card—and it enabled the customer, for the first time, to pay outstanding balances over time. It was soon followed by MasterCard, another franchise operation that sold its name and facilities to banks and finance companies that used a card with its generic logo. Bank of America divested itself of the card business several years after introduction, and the operation became franchised, with the card being offered by many banks that paid the licensor a fee. By the late 1960s, credit cards began revolutionizing the way in which payments were made for purchases, replacing cash and checks in many instances. The use of cards grew exponentially over the next four decades and by 2000 represented the major form of consumer debt outstanding.

The growth of credit cards was made possible by the rapid growth of the COMMERCIAL PAPER market. Bank holding companies and finance companies were able to borrow for short terms in the market and use the proceeds to buy receivables from merchants at a small discount from the customer’s purchase price. The growth in the commercial paper market paralleled the growth of credit cards, allowing nonbanks to offer the services as well. Today credit cards are offered by banks and financial companies having access to the commercial paper market as a source of low-cost funding.

The outstanding amount of credit card debt has become a closely watched statistic in order to determine the condition of consumers in general, since two-thirds of the U.S. economy is generated by consumer spending.

Further reading

- Calder, Lendol. Financing the American Dream. Princeton, N.J.: Princeton University Press, 1999.

- Evans, David S., and Richard Schmalensee. Paying with Plastic: The Digital Revolution in Buying and Borrowing. Cambridge, Mass.: MIT Press, 1999.

- Mandell, Lewis. The Credit Card Industry: A History. Boston: Twayne Publishers, 1990.