Consumer credit and household debt

The use of consumer credit has become an increasingly important feature of the U.S. postindustrial economy in general and household financial management in particular. In fact, the recent economic boom of the mid-2000s was primarily fueled by consumer spending that was financed by soaring levels of household borrowing. Although the Great Recession of 2008–2010 has generated intense debate over indolent consumption financed by household debt, Lendol Calder (2001) sagely cautions that each generation has issued moralistic warnings against increasing dependence on consumer credit. And they have typically resonated during major economic downturns in the 19th and 20th centuries—most notably the Great Depression of the 1930s.

Background

Historically, the American debate over credit and debt has been shaped by Puritan sociocultural values that regulated appropriate moral behavior in the personal/social/ household sphere (Manning 2000). The uniquely American response, as guided by the Weberian notion of the geist or “spirit of capitalism,” reinforced household thrift in the social realm by rewarding self-discipline and hard work in the economic realm through reinvestment of household wealth in economic enterprises (Weber 1905). For example, Calvinism promoted material asceticism whereby hard work and frugality were valued over leisure and consumption. The ability to resist indolent material desires and thus demonstrate one’s worthiness for salvation in the afterlife was confirmed through the accumulation of wealth. The more frugal the lifestyle and commitment to self-denial, then the more household assets that could be publically revealed as virtuous evidence of appropriate moral conduct. Indeed, Ben Franklin’s moralistic prescription that “a penny saved is a penny earned” is firmly embedded in American culture as universal wisdom for personal success. Ultimately, the Protestant work ethic has contributed to the emergence of a national American entrepreneurial culture that promotes “good” debt while increasing personal wealth and discourages “bad” debt that merely satisfies consumptive wants and desires.

The use and dependence on credit has varied over time. In rural agricultural areas, for example, farmers routinely rely on business and personal credit during the planting and growing seasons, which is then repaid with proceeds from the harvest. Social attitudes encouraged borrowing for costly equipment like a mechanical thresher or a multipurpose tractor because they were “good” debts: business investments that increased labor productivity and economic self-sufficiency. Similarly, buying a sewing machine on credit was viewed as a prudent investment since it reduced household expenditures on storebought clothes and could generate supplemental income by taking in seamstress work. Even local merchants were relatively stingy with their self-financed “open book” credit. By cultivating consumer loyalty, they had to balance greater store sales that encouraged responsible consumption while limiting household debt to manageable risk levels for maintaining adequate store inventories. Hence, from the late 19th through the mid-20th century, banks prioritized the lending of relatively scarce credit to economically productive activities. In the process, this policy imposed greater social control over discretionary household expenditures and leisure activities as they were more closely regulated by the religious and community norms of the period.

Today, the responsible use of consumer credit is as important as the prudent management of household income. Although Americans have assumed much higher levels of debt to maintain their families, the social dichotomy of good versus bad debt still persists. For instance, a home mortgage is perceived as a good debt since it satisfies an important household need while accumulating a substantial future asset. Student loans are generally viewed as good human capital investments since higher education enhances occupational mobility and income growth. Of course, even good debt can lead to financial distress, such as when housing prices exceed family resources or costly terms of adjustable-rate mortgages greatly exceed the financial gains of home ownership. Accordingly, borrowing for expensive college or vocational training programs may be bad debt by consigning the borrower to many years of debt servitude. This may result from circumstances outside of the borrowers’ control, such as deteriorating macroeconomic conditions (recession) or declining demand for specific occupational skills due to outsourcing (software engineers).

Bank Loans and Household Debt in Postwar United States

The post–World War II growth in household consumer debt has been shaped by supply— changing bank underwriting standards—and demand—higher material standard of living financed by easy access to consumer credit. In terms of the former, the national system of community banks was more risk averse in its loan approval process. Traditionally, bank lending was based on the three Cs of consumer loan underwriting: character, collateral, and capacity. That is, the likelihood that the borrower would repay the loan (character), whether the borrower had sufficient assets to satisfy the loan in case of default (collateral), and whether the borrower possessed adequate income to repay the new loan based on existing household debts and expenses (capacity). These more stringent bank underwriting standards meant that loans were repaid over a shorter period of time (e.g., three-year auto loans), which accelerated the accumulation of household assets and collateral and thus reduced lender risk. Furthermore, loan applications were often rejected due to relatively high monthly payments and the inability to defer payments one to two years, as is common today. As a result, community banks enforced local standards of financial responsibility until they became absorbed by national banks during the merger and acquisition frenzy of the 1990s and 2000s.

Until the early 1980s, state usury laws restricted risk-based pricing policies, which off er high interest rate loans to less creditworthy consumers, while unsecured bank credit cards were not generally profitable and thus limited to higher-income/low-risk customers They were off ered primarily as a convenience to the banks’ best customers or to cement consumer loyalty with specific retailers through private issue cards such as Sears and Montgomery Ward (Manning 2000). In fact, consumer credit cards were barely profitable until after the 1981–1982 recession. Furthermore, the rapid growth of the U.S. manufacturing economy and its high levels of unionization in the 1950s and 1960s led to increasing real wages and expansion of the U.S. middle class, with high saving rates even in one-income households. For most Americans, household debt was limited primarily to low-cost mortgage (20- to 25-year fixed) and auto (one car) loans; higher education was aff ordable and generally self-financed. And interest payments on consumer loans were tax deductible until 1990. The 1986 Tax Reform Act featured a 4-year phased out period for deducting consumer loan finance charges, including credit cards and autos. A tax loophole that allowed home equity loans to retain their tax deductible status is responsible for their explosive growth in the 1990s and 2000s.

The consumer lending revolution took off after the 1981–1982 recession, as banking deregulation and international competitive pressures contributed to the profound transformation of U.S. society—from an industrial manufacturing to a postindustrial consumer economy. This enormous economic stress, which included the loss of millions of blue-collar manufacturing jobs, contributed to the sharp increase in demand for consumer credit among middle- and working-class families. This financial situation was exacerbated by the long-term decline in real wages beginning in the late 1970s. Furthermore, with high inflation in the late 1970s and early 1980s, peaking at over 15 percent annually, consumer borrowing became a prudent strategy as falling real wages were counterbalanced by the declining cost of borrowing. With the end of state usury laws and low inflation by 1984 (under 5 percent), the rising consumer demand and real cost of borrowing led to a dramatic shift in lending to less creditworthy households as strategically guided by risk-based pricing policies (Evans and Schmalensee 2005; Manning 2000; Nocera 1994).

WHAT HAPPENED TO CONSUMER USURY LAWS?

In 1978, federal usury laws were essentially eliminated with the landmark U.S. Supreme Court decision Marquette National Bank of Minneapolis v. First of Omaha Service Corp. (439 U.S. 299). This ruling invalidated state antiusury laws that regulated consumer interest rates against nationally chartered banks that are headquartered in other states. Only the Office of the Comptroller of the Currency, through its enforcement of laws enacted by the U.S. Congress, can impose such restrictions on national banks. This resulted in the exodus of major banks to states without the restrictions, such as South Dakota and Delaware. The deregulation of interest rates was followed by the 1996 U.S. Supreme Court decision Smiley v. Citibank (517 U.S. 735), which effectively ended state limits on credit card penalty fees. Penalty and service fees now pervade the industry and are its third largest revenue stream following consumer interest and merchant fees. As a result, federal pre-emption has become the guiding principle of bank regulation and shifted authority from the individual states to the U.S. Congress.

With the extraordinary consolidation of the U.S. banking industry over the last three decades, the top three credit card companies (Citibank, Chase, Bank of America) control nearly two-thirds of the credit card market (Manning 2009),and state usury laws apply to a very small fraction of total consumer loans, primarily offered by state chartered banks and other nonbank financial institutions. The exception is federally chartered credit unions whose interest rates are capped at 18 percent. The result has been soaring finance rates and fees—even with the effective interest rate or cost of funds charged to major banks at near zero in 2010. Although more stringent federal credit card regulations were enacted with the 2010 CARD Act, efforts to mandate new federal interest rate limits were soundly defeated by the U.S. Congress in spring 2010.

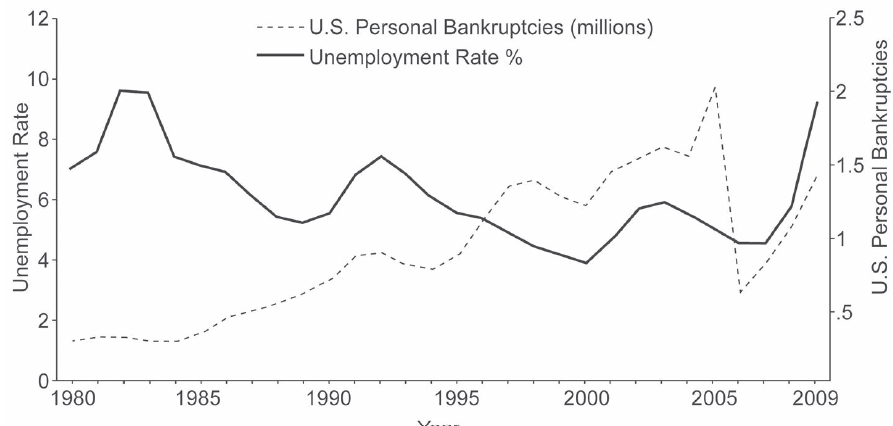

As banks invested in new technological efficiencies, including automatic teller machines (ATMs) and credit card processing systems, they began pursuing greater profit opportunities by marketing to less-creditworthy groups (students, working poor, senior citizens, immigrants, handicapped) and then increasing household debt levels. Not surprisingly, by dramatically reducing loan underwriting standards, consumer lines of credit and household debt levels soared. For example, consumer credit card debt jumped from $70 billion in 1982 to nearly $960 billion in 2008, while the national household savings rate fell from nearly 10 percent to about–1 percent. By the mid-1990s, an extraordinary pattern emerged: U.S. bankruptcy filings nearly doubled while unemployment rates fell sharply. Between 1994 and 1998, consumer bankruptcies soared from 780,000 to 1.4 million (79.5 percent) while national unemployment dropped from 6 percent to about 4.2 percent (–30 percent). This pattern is shown in Figure 1. For the first time, the deregulated banking industry, with its diluted underwriting standards, had increased the amount and cost of household debt beyond the capacity of millions of families to repay their loans. The situation has been exacerbated by greater job insecurity, rising cost of housing, soaring health-related expenses, climbing cost of higher education, and low household saving rates. As a result, unexpected social and financial emergencies have pushed millions of responsible Americans over the edge of financial solvency (Manning 2000, 2005; Sullivan, Warren, and Westbrook 2000; Warren and Tyagi 2003).

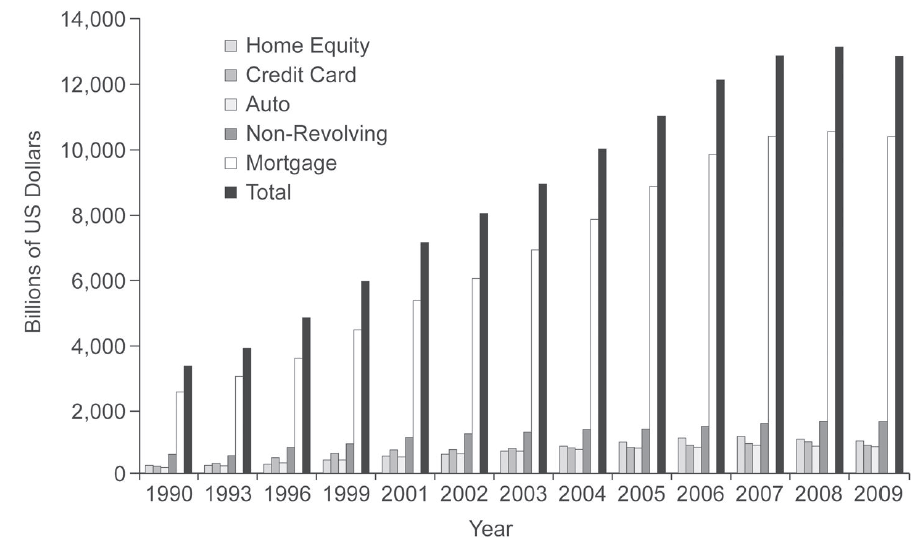

Undeniably, the dependence of U.S. households on consumer credit and debt exploded over the last decade. For instance, between 1990 and 1999, total household debt increased from about $3.3 trillion to $6 trillion. As the U.S. Federal Reserve exercised its monetary policy power by sharply reducing the cost and increasing access to consumer credit, the U.S. economy surged, feasting on unprecedented levels of debt-based household consumption (Baker 2009; Zandi 2009; Fleckenstein and Sheehan 2008). From the onset of the 1999 recession to the peak of the bubble period in 2008, U.S. household debt jumped to over $12 trillion—an extraordinary increase of $6 trillion! More striking is the composition of this growth in debt. Americans were seduced to assume unprecedented levels of “good” mortgage debt—from $4.2 trillion in 1999 to almost $10.4 trillion in 2008. Similarly, credit card debt surged from $611 billion in 1999 to $958 billion in 2008 (U.S. Federal Reserve Board 2009). (See Figure 2.) Admittedly, over $400 billion in credit card debt and even more for other consumer purchases (autos, boats, all-terrain vehicles, vacations, college tuition) are included in these mortgage statistics due to the ease of refinancing during this period. Incredibly, the average U.S. household’s indebtedness, as measured by its share of household disposable income, has jumped from 86 percent in 1989 to more than 140 percent today (Mischel, Bernstein, and Shierholz 2009).

The U.S. Economy on Steroids: How We Got Here

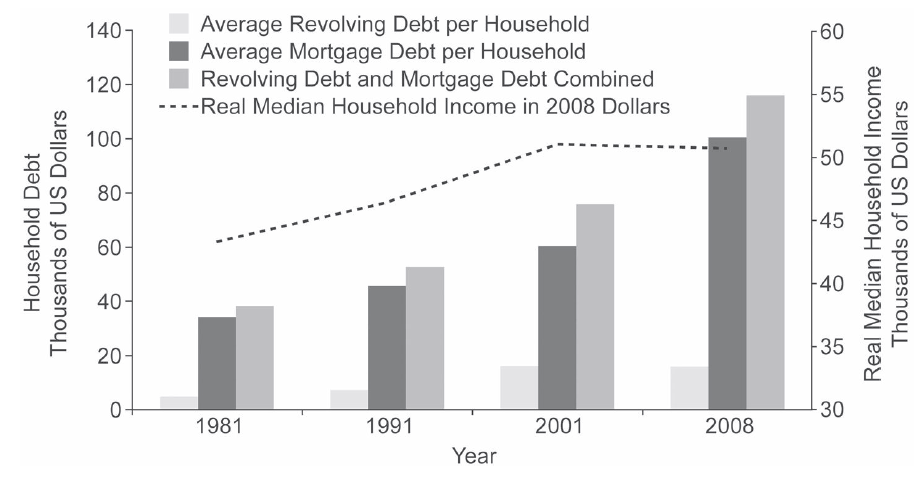

Unlike the past three business cycle recessions (1981–1982, 1990–1991, 2001), the ongoing 2008–2010 consumer-led recession is distinguished by unprecedented levels of household debt, declining family income, and sharply reduced household wealth (see Figure 3). Indeed, in the aftermath of these previous recessions, real household income increased significantly (18.5 percent)—from $41,724 in 1981 to $49,455 in 2001—whereas it declined slightly (–1.1 percent) to $48,931 in 2008. Similarly, housing prices rose during the last two recessions (5.6 percent in 1990–1991 and 6.3 percent in 2001), whereas they fell at least 12 percent in 2008 and over 10 percent in 2009.

Overall, U.S. economic recoveries during this 20-year period were largely financed by employment growth, increased real income, and increased household debt. Significantly, revolving (credit card) debt jumped much more rapidly than home mortgage debt during the 1980s and 1990s. For example, after adjusting for inflation, average revolving household debt jumped from $3,500 in 1981 to $6,700 in 1991 and then to $16,100 in 2001, while average mortgage debt jumped from $29,200 in 1981 to $42,500 in 1991 and then to $60,600 in 2001. With soaring housing prices, weakening loan underwriting standards, and easy home equity extraction, the U.S. housing bubble period (2001– 2006) witnessed the dramatic growth of mortgage debt and plummeting home asset values; average home owner equity fell from 70 percent in 1980 to 38 percent in 2009. In real 2008 dollars, average household mortgage debt soared from $60,600 in 2001 to $94,500 in 2008, while revolving debt increased marginally over the same period, from $16,100 to $16,300. Between 2001 and 2006, it is estimated that over $350 billion in credit card debt was paid off through mortgage refinancings and home equity loans.

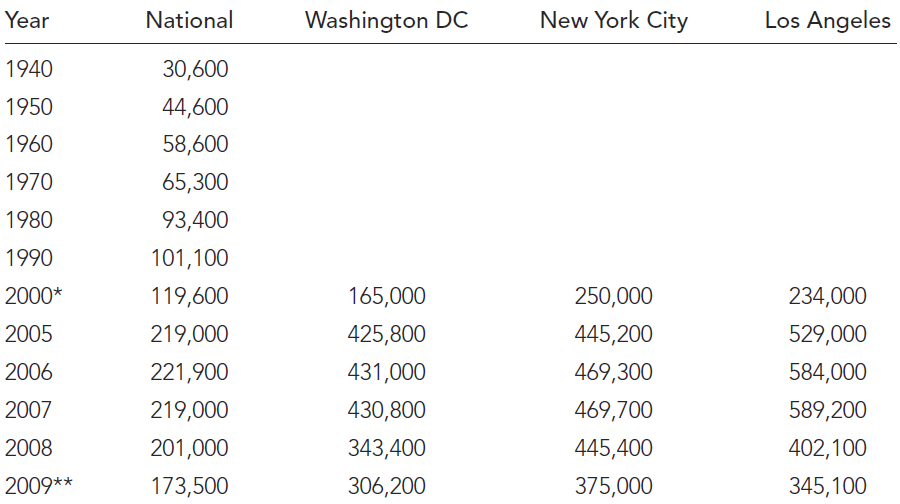

The U.S. economy experienced a precariously fragile yet incredibly robust economic expansion over 2001–2006 that was based on unsustainable access to global capital for financing consumer credit. Indeed, as the household consumer savings rate dropped from over 8 percent in the mid-1980s to near zero at the end of the 1990s, residential housing values soared to extraordinary heights; average housing prices slowly rose from about $45,000 in 1950 to $101,000 in 1990 and then soared to nearly $150,000 in 2000 before peaking at about $222,000 in 2006. The accelerated velocity of the real estate roller coaster ride is illustrated in Table 1. With more stringent underwriting standards, including income verification and size of down payments, the average sales price of residential homes fell below the rate of inflation in the 1980s, rose from $93,400 to $101,100 in 1990, and then gained momentum with diluted lending standards in the 1990s, jumping nearly 50 percent to $149,600 in 2000.

It is the five-year bubble period (2001–2005) that witnesses the sharp upward acceleration in average sale prices—nearly 50 percent to $219,000 in 2005—followed by an abrupt stagnation in sale prices in 2006 (about 1 percent increase) and then a 22 percent decline over the next three years to $173,500. More striking is the regional variation in the U.S. real estate market. On the West Coast, average sales prices in Los Angeles soared from $234,000 in 2000 to $584,000 in 2006 and then plummeted to $345,000 in 2009. On the East Coast, average sales prices in New York City jumped from $250,000 in 2000 to $469,000 in 2006 and dropped to $375,000 in 2009. In the nation’s capital, prices more than doubled in this five-year period, from $165,000 to $431,000, and then fell to $306,000 in 2009. Housing prices are expected to register further declines over the next three to four years, depending upon the level of public price support, willingness of lenders to write down mortgage principal to near market values, and job growth in specific regions of the country.

As federally subsidized general service entities (GSEs), the mortgage lenders Fannie Mae and Freddie Mac diluted their underwriting standards in order to expand their market share through the widespread packaging and resale of loans through assetbacked securities (controlling over $5 trillion of the $10 trillion residential mortgage market in 2008), U.S. home ownership rates reached a historic high of almost 69 percent in 2007. In the process, the sizzling U.S. housing market created an enormous increase in “paper” asset wealth for middle-class Americans that fueled the dramatic growth of unsecured lines of credit that underlies the second credit card bubble. The massive increase in United States consumer debt—from almost $8 trillion in 2001 to nearly $13 trillion in 2008—was increasingly financed by foreign investors; the U.S. share of global savings peaked at nearly 65 percent in 2005 and had already fallen below 50 percent in 2008, as countries with balance-of-trade surpluses redirected their liquidity to national economic stimulus projects.

SUBPRIME MORTGAGES AND U.S. FINANCIAL SYSTEM MELTDOWN

A distinguishing feature of the 2008–2010 recession is the central role of the U.S. housing market collapse. On the supply side, sharply diluted underwriting standards kept real estate prices soaring, which attracted a record number of speculative investors. Why invest in risky stock markets when you can make huge returns on borrowed money? To keep the real estate engine fully lubricated, it required new groups of home owners who were increasingly less creditworthy. The rise of subprime mortgages simply meant that borrowers could not qualify for traditional government-insured loans such as FHA mortgages.

In marketing the American dream of home ownership, real estate agents and brokers made bigger commissions by selling larger loans. The key was to qualify consumers for the home mortgage, which often included an inflated property appraisal, and then sell the loan via brokers to major Wall Street investment banking units. Surprisingly, a wide range of comparatively risky mortgage loans were created and approved by bank regulators that were impossible for millions of consumers to afford. These included 2/28 and 3/27 adjustable-rate mortgages that often started at 1–2 percent APR and jumped to over 9–10 percent APR after the two- or three-year introductory period, five-year interestonly mortgages, “no doc” or unverified financial information loans, and pick-a-payment loans that permitted negative amortization. Of course, the inability to save for a down payment was not a major problem and even loan closing costs could be financed and added to the mortgage. So, while low-income and largely urban minorities became the first casualties of the subprime catastrophe, it was primarily due to their lack of financial resources and their acceptance of the worst borrowing terms rather than irresponsible money management. Middle- and upper-income households also took subprime mortgages, but they tended to have more financial resources and thus were able to prolong the foreclosure process through the late 2000s.

On the demand side, major Wall Street investment firms were buying, packaging, and reselling these subprime mortgages via asset-backed securities (ABS) that were sold to institutional investors (banks, insurance companies, mutual funds) throughout the United States and around the world. Major bond rating agencies like Moody’s and Fitch were seduced by lucrative Wall Street consulting agreements and fueled the global sale of these securitized mortgages by certifying them as investment grade, which enabled the securities to be insured. Wall Street investment firms such as Goldman Sachs purchased billions of dollars of subprime mortgages, packaged and sold them as investment- grade securities, and then bought hedge insurance from companies like AIG (bailed out by the U.S. government with over $183 billion and counting) that essentially bet that the mortgages would not be paid—and they received billions in insurance payments. Other mortgage-backed securities were even riskier, featuring specific strips of the subprime mortgage. For example, the riskiest securities included the first 10 percent of the subprime mortgage, the next riskiest was the next 20 percent, with the least risky being the lowest strips.

As long as the housing bubble was inflating, the riskiest securities outperformed all other ABS products since the liquidation value of the homes at least satisfied the value of the mortgages. Why invest in 8 percent ABS products when the 15 percent ABS products appeared to be very low risk? Of course, when the housing bubble burst, the riskiest mortgage-backed securities immediately became worthless. As investors sought to mitigate their losses, they incentivized their mortgage servicers to accelerate foreclosure proceedings in the hope of recovering some economic value. This created a domino effect that exacerbated the fall in home sale prices and further increased their investment losses. In an attempt to stabilize the housing market, the U.S. Congress provided over $200 billion to home mortgage finance giants Fannie Mae and Freddie Mac to purchase delinquent mortgages. Together with government programs that offer lower interest rates but without principal reductions, the current housing market has reached a soft floor that will result in at least 4 million to 5 million foreclosures over the next three years. This means that the subprime mortgage catastrophe will continue, with the cost eventually exceeding a trillion dollars. It is for this reason that the U.S. Congress enacted more stringent regulations and oversight of Wall Street as specified in the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act.

Furthermore, both consumer mortgage and credit card loans increasingly featured adjustable-rate terms in the 2000s that have stretched household debt capacity to its limits; monthly minimum payments continue to rise, whereas the value of household assets continues to fall. Today, with the virtual disappearance of home equity loans and the sharp cutback in bank card lines of credit, the collapse of the double financial bubble has left most U.S. households maxed out on their credit, with debt levels that they cannot possibly repay in full given the current trends of declining household income and wealth. Additionally, the rising debt service of U.S. households has dramatically reduced consumer discretionary spending. This rippled throughout the United States and global economies in 2008 and 2009. In the process, it triggered sharp reductions in macroeconomic growth and rising unemployment rates (combined unemployed and underemployed at nearly 25 percent in the United States) that are the primary forces shaping the ongoing consumer-led recession in the United States. As a result, with over 2.3 million foreclosures in 2008, millions of Americans are confronting the stark reality that they may lose their homes and even their jobs in the early 2010s. An estimated 5 to 7 million homes are expected to enter into foreclosure proceedings over the next three years.

Conclusion: After the Double Financial Bubble

Like an athlete on steroids, the U.S. economy was not nearly as powerful as it seemed in the mid-2000s as it bulked up on cheap financial “boosters” from major trade partners such as China, Japan, and Middle East oil producers. With their enormous trade surpluses with the United States, which underlies their huge dollar-denominated currency reserves, these “bankers of necessity” were happy to supply low-cost loan “fixes” as long as it kept the U.S. consumer society addicted to its massive volume of imported goods and services (Baker 2009; Fleckenstein and Sheehan 2008; Schechter 2007). For example, China purchased the mortgage-backed securities that fueled the housing boom in order to provide compliant U.S. consumers with building materials (e.g., cheap sheetrock), interior furnishings, electronics and appliances, and clothing and other personal items. As long as inexpensive credit was easily available in the United States, then Americans were able to refinance and leverage their skyrocketing home values through ever lower interest rates (Muolo and Padilla 2010; Zandi 2009; Schechter 2008). This meant that while real U.S. wages continued to decline in the 2000s, Americans believed that they actually were better off economically due to impressive stock market (401(k)) and home equity gains (Mishel, Bernstein, and Shierholz 2009; Leicht and Fitzgerald 2007; Manning 2005).

As the financial steroids began to wear off , the U.S. financial system abruptly collapsed in September 2008, and the resulting institutional paralysis left the nation in shock and the economy in turmoil (Zandi 2009; Baker 2009; Schechter 2008). Like the poststeroids athlete, the United States is struggling to recover its former glory while its economic foundation and financial infrastructure remain perilously debilitated. Furthermore, after the bubble burst, overleveraged households now must pay down their record consumer debts almost exclusively from salaries and wages that continue to fall while millions of Americans are unable to find gainful employment. No wonder that record bankruptcy rates are expected over the next three to four years. With the lack of available credit, moreover, the pendulum of the market has swung in the opposite direction as asset sale prices do not necessarily reflect intrinsic value since fewer people can qualify for loans. Shockingly, commercial and residential real estate is often sold at below its replacement cost—that is, homes and office buildings can be purchased for less than it costs to build them! Together with the glut of houses on the market, these are the key reasons that the construction and real estate industries will not recover in the near term. And, since it is unlikely that real household income will reverse its long-term slide in the near future, the timing of the next upswing in the residential real estate market is crucial to restoring consumer confidence as well as augmenting shrinking family incomes. These factors both underlie the depth of the current recession and the policy prescriptions for restoring the health of the U.S. economy.

Robert D. Manning and Anita C. Butera

See also Bank Bailouts; Debt, Deficits, and the Economy; Financial Regulation; Trade Deficits (and Surpluses)

Further Reading

- Baker, Dean, Plunder and Blunder: The Rise and Fall of the Bubble Economy. New York: Polipoint Press, 2009.

- Barber, Benjamin R., Consumed: How Markets Corrupt Children, Infantilize Adults, and Swallow Citizens Whole. New York: W. W. Norton, 2007.

- Calder, Lendol, Financing the American Dream: A Cultural History of Consumer Credit. Princeton, NJ: Princeton University Press, 2001.

- Cohen, Lizabeth, A Consumers’ Republic: The Politics of Mass Consumption in Postwar America. New York: Vintage, 2004.

- Evans, David, and Richard Schmalensee, Paying with Plastic: The Digital Revolution in Buying and Borrowing, 2d ed. Cambridge, MA: MIT Press, 2005.

- Fleckenstein, William, and Frederick Sheehan, Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. New York: McGraw-Hill, 2008.

- Leicht, Kevin T., and Scott Fitzgerald, Post-Industrial Peasants: The Illusion of Middle Class Prosperity. New York: Worth, 2007.

- Mann, Ronald J., Charging Ahead: The Growth and Regulation of Payment Card Markets around the World. New York: Cambridge University Press, 2007.

- Manning, Robert D., Credit Card Nation: America’s Dangerous Addiction to Credit. New York: Basic Books, 2000.

- Manning, Robert D., Living with Debt: A Life Stage Analysis of Changing Attitudes and Behaviors. Charlotte, NC: Lending Tree.com, 2005.

- Manning, Robert D., “The Evolution of Credit Cards.” Credit Union Magazine (October 2009): 35–38.

- Mishel, Lawrence, Jared Bernstein, and Heidi Shierholz, State of Working America, 2008/2009. Ithaca, NY: Cornell University Press, 2009.

- Muolo, Paul, and Mathew Padilla, Chain of Blame: How Wall Street Caused the Mortgage and Credit Crisis. New York: John Wiley, 2010.

- Nocera, Joseph, A Piece of the Action: When the Middle-Class Joined the Money Class. New York: Simon & Schuster, 1994.

- PEW Health Group, Still Waiting: Unfair or Deceptive Credit Card Practices Continue as Americans Wait for New Reforms to Take Eff ect. Washington, DC: Pew Charitable Trusts, 2009.

- Schechter, Danny, In Debt We Trust: America before the Bubble Burst. Film. DisInformation Films, 2007. http://www.Indebtwetrust.org

- Schechter, Danny, Plunder: Investigating Our Economic Calamity and the Subprime Scandal. New York: Cosimo Books, 2008.

- Sullivan, Teresa A., Elizabeth Warren, and Jay L. Westbrook, The Fragile Middle Class: Americans in Debt. New Haven, CT: Yale University Press, 2000.

- U.S. Federal Reserve Board, Consumer Credit and Household Debt Statistical Releases. 2009. http://www.creditcardnation.com/trends.html

- Warren, Elizabeth, and Amelia Warren Tyagi, The Two-Income Trap: Why Middle-Class Parents Are Going Broke. New York: Basic Books, 2003.

- Weber, Max, The Protestant Ethic and the Sprit of Capitalism. London: Unwin Hyman, 1905.

- Zandi, Mark, Financial Shock: A 360º Look at the Subprime Mortgage Implosion, and How to Avoid the Next Financial Crisis. Upper Saddle River, NJ: FT Press, 2009.